How Does the Claims Portal Work?

An innovative approach to secure communication and the safe transfer of information in the insurance industry.

Our unique electronic order tracking, information sharing, and document transmission software is essentially both an electronic courier system, as well as a secure method for a broad range of vendors and stakeholders to communicate directly and safely with the Insurance Industry.

A version of this system has in fact been operational in the New Business sector of the Insurance Market as well as in a number of the major Canadian Banks for the past 12 years. This system has been up and running for the past 6 years within Casualty Insurance Companies in Canada.

Based on server-side technology, RIDM’s Claims Portal does not require any software to be downloaded to a given computer and uses the same security mechanisms as online banking.

Our web-based software is compatible with most browsers and will not impede or interfere with an Insurer’s existing desktop systems. It can also be configured to link with back-office solutions and in-house document management systems, if desired.

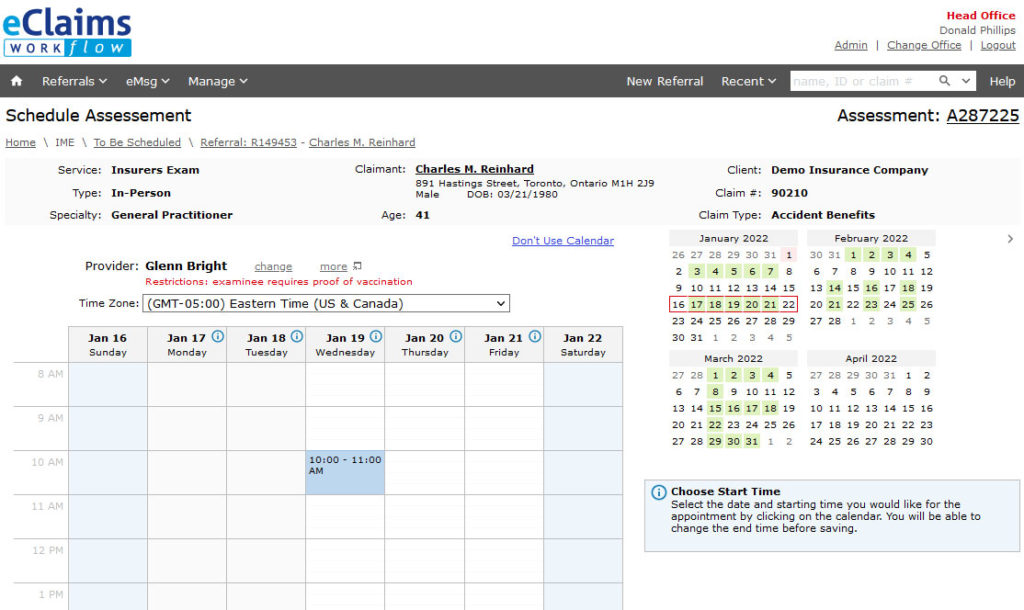

The process begins as the Insurance Company completes the Claims Management Request Form in the portal. Documents can then be attached at any time during the life cycle of the claim.

As other parties become involved, namely the medical assessor(s) and lawyer(s), they are given access to pertinent claim documents in the portal. The process of sending electronic files and having all parties involved getting their relevant information immediately, saves time and resources. There are also no costs associated with using RIDM’s Claims Portal.

The Online Referral Process

RIDM’s Claims Portal is an innovative approach to secure communication and the safe transfer of information in the insurance industry. Our unique portal based electronic order tracking, information sharing, and document transmission software is both an electronic courier system, as well as a secure method for a broad range of vendors and stakeholders to communicate directly and safely with the insurance industry.

Appointments take place within 10-15 business days from point of referral unless otherwise specified.

Able to provide after hours and weekend appointments in order to accommodate customer needs.

Appointment confirmation with regard to date and time are provided to the customer within 4 hours of referral.

Transportation, interpreters, and hotel/flight coordination are arranged at no additional charge to the customer.

A safe and secure communication solution that includes:

- Web-based with no software to be installed.

- No Cost to the Customer

- Secure document exchange.

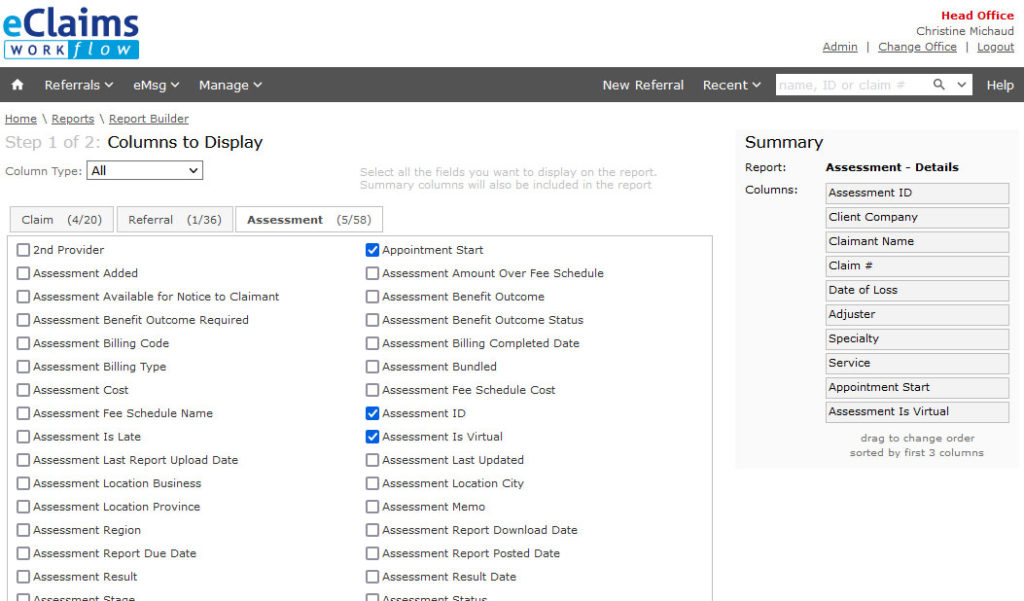

- Real-time messaging and file activity tracking.

- Electronic Assessment Reports.

- Quarterly activity reports tailored to customer needs (i.e. Costs, Time-Service, No-Shows etc.).

- Clerical cost reduction.

- Reduced corporate risk and liability through secure foot-printed communication.

- Ease of network interfacing through Portal Based E- Solution technology.

- By moving documents in a secure electronic fashion, your company is taking another step toward operating in an environmentally sustainable manner.